Stripe acquires a stablecoin company for $1.1

billion

Stripe has acquired the stablecoin platform Bridge for $1.1 billion.

It's official: Stripe has acquired Bridge, a stablecoin platform, for $1.1 billion.

This is Stripe's largest acquisition to date, as well as the largest acquisition in Web3 history. Which raises the question: Why?

Why would Stripe spend more than a billion dollars to acquire a stablecoin platform?

Stable... what?

Stablecoins are cryptocurrencies that are, well, stable. The value of a stablecoin is “pegged” to the value of another currency. To better understand this, let's consider an example:

One of the most popular stablecoins is USD Coin. USDC is pegged to the US dollar, which means that 1 USDC always equals $1.

Another popular stablecoin is Tether, USDT, which is also pegged to the US dollar.

Why spend $1.1 billion on a crypto company?

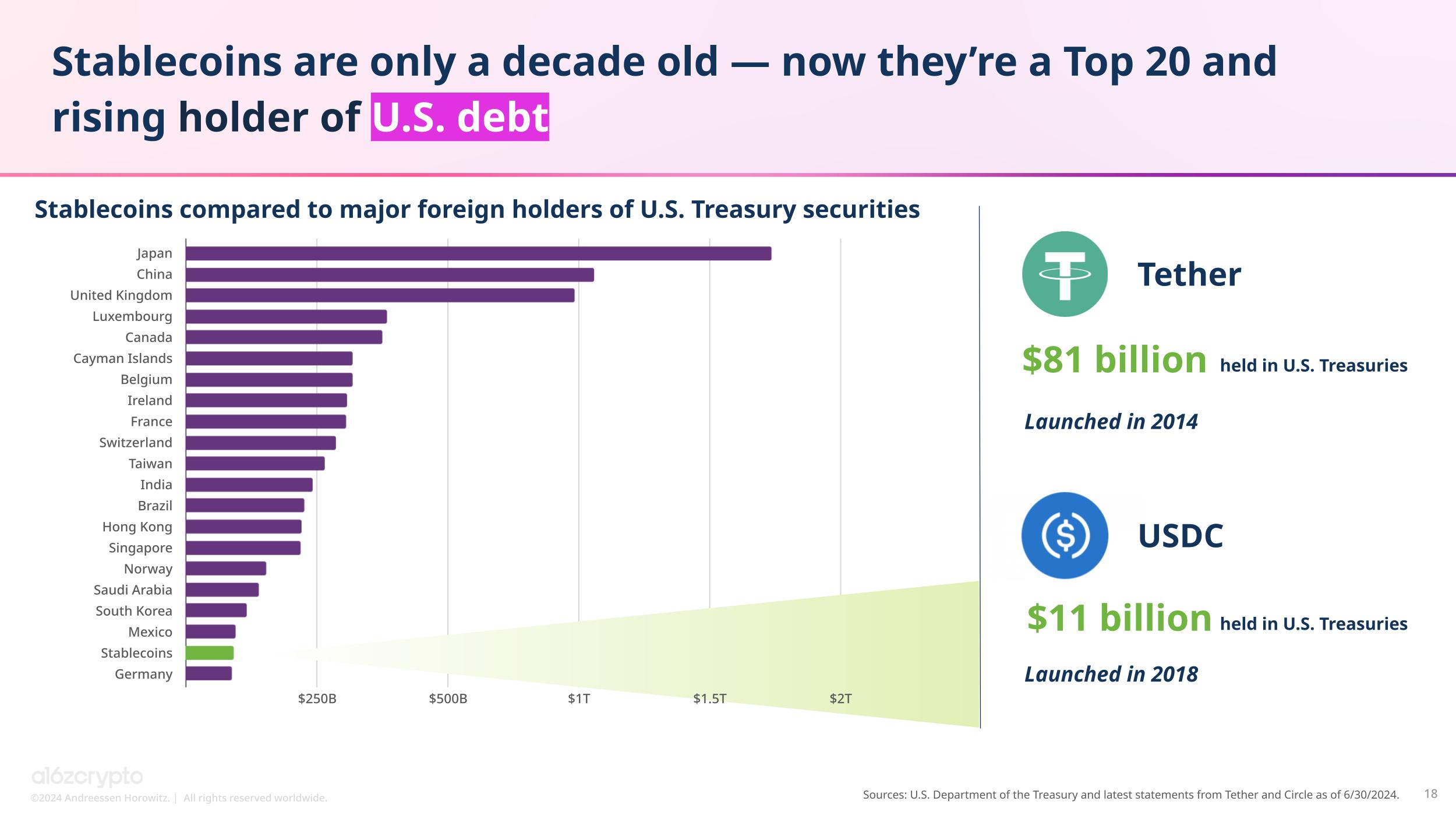

Here's a graph that should give you an idea:

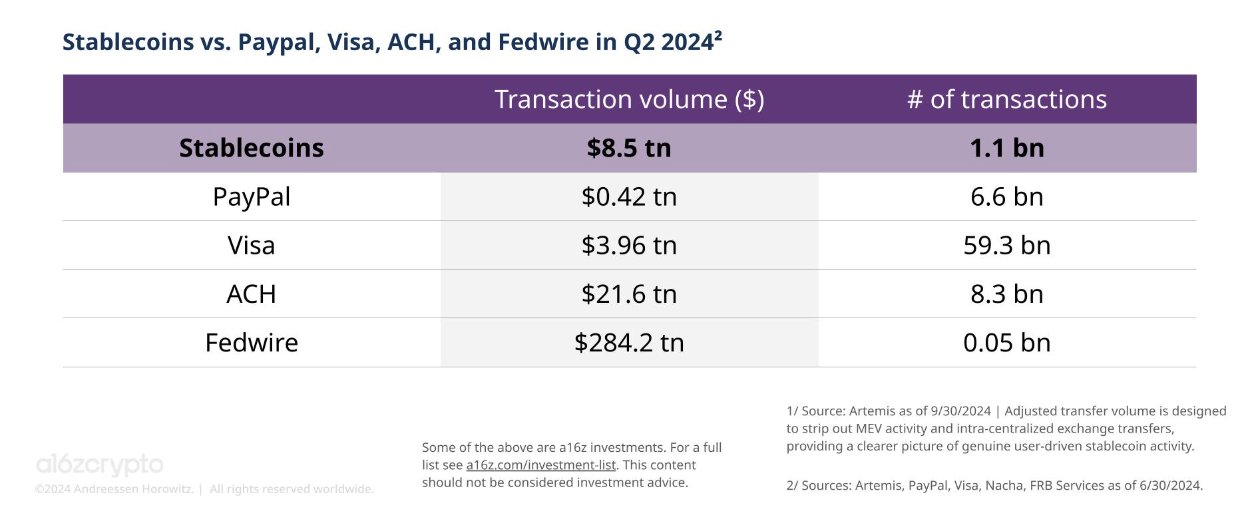

Look at that transaction volume! It's through the roof. Here's a longer breakdown:

Stablecoins are only a decide old, yet they're a top 20 holder of US debt, surpassing Germany.

And that numbers are still going up:

To get a better idea of how big stablecoins are, it's reported that stablecoins are now doing 20x the transaction volume of PayPal and 2x of Visa:

Stripe isn't just following a hunch. It's following the data.

How does Bridge align with Stripe strategically?

Bridge is the Web3 version of Stripe.

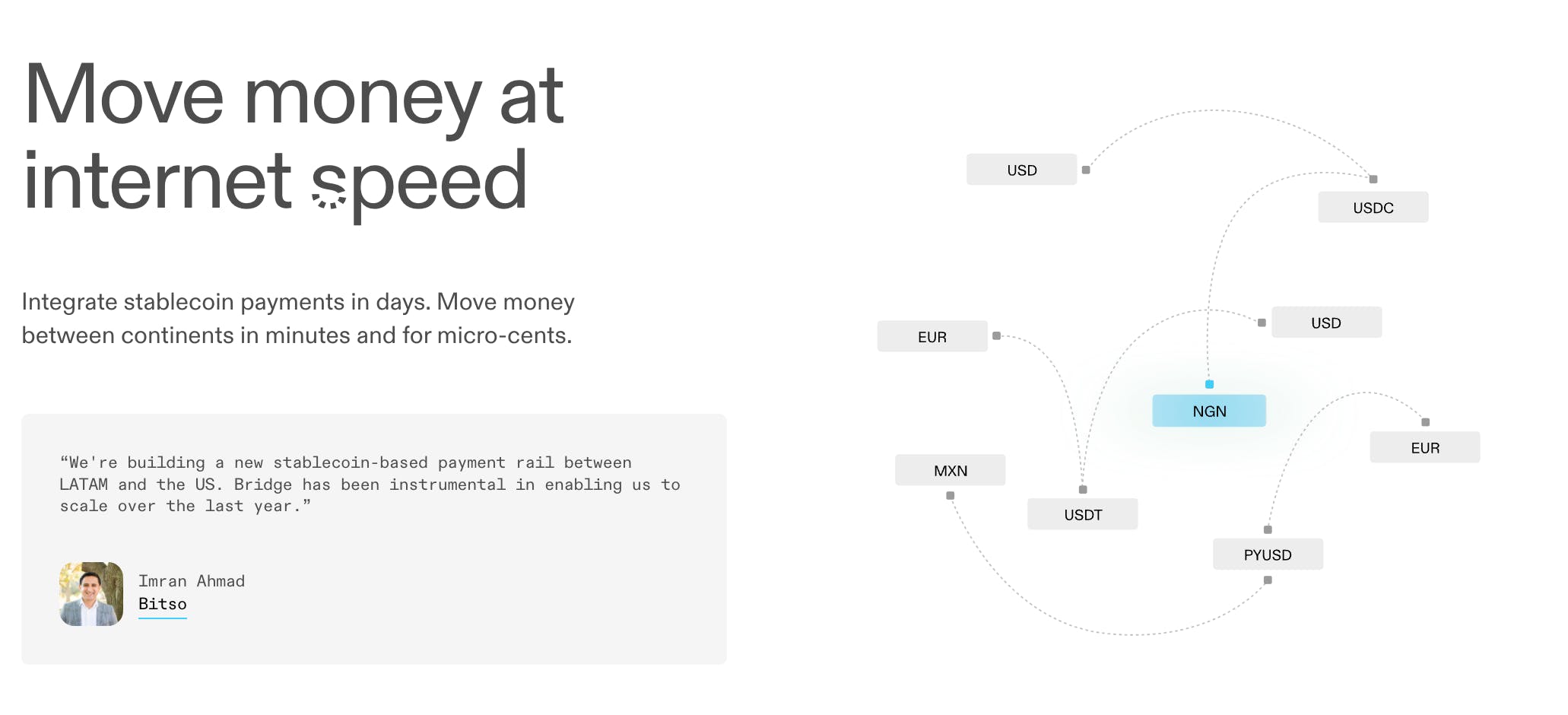

They provide a "stablecoin API for developers," allowing you to "move, store, and accept stablecoins with a few lines of code."

Bridge raised over $58 million by Sequoia Capital and other smaller firms.

Stablecoins vs fiat

Why do people use stablecoins rather than fiat? There are several reasons:

No big transaction fees for cross-border payments.

The money arrives quicker. No banks with regulations, no verification, etc.

They're decentralized. Governments don't control stablecoins.

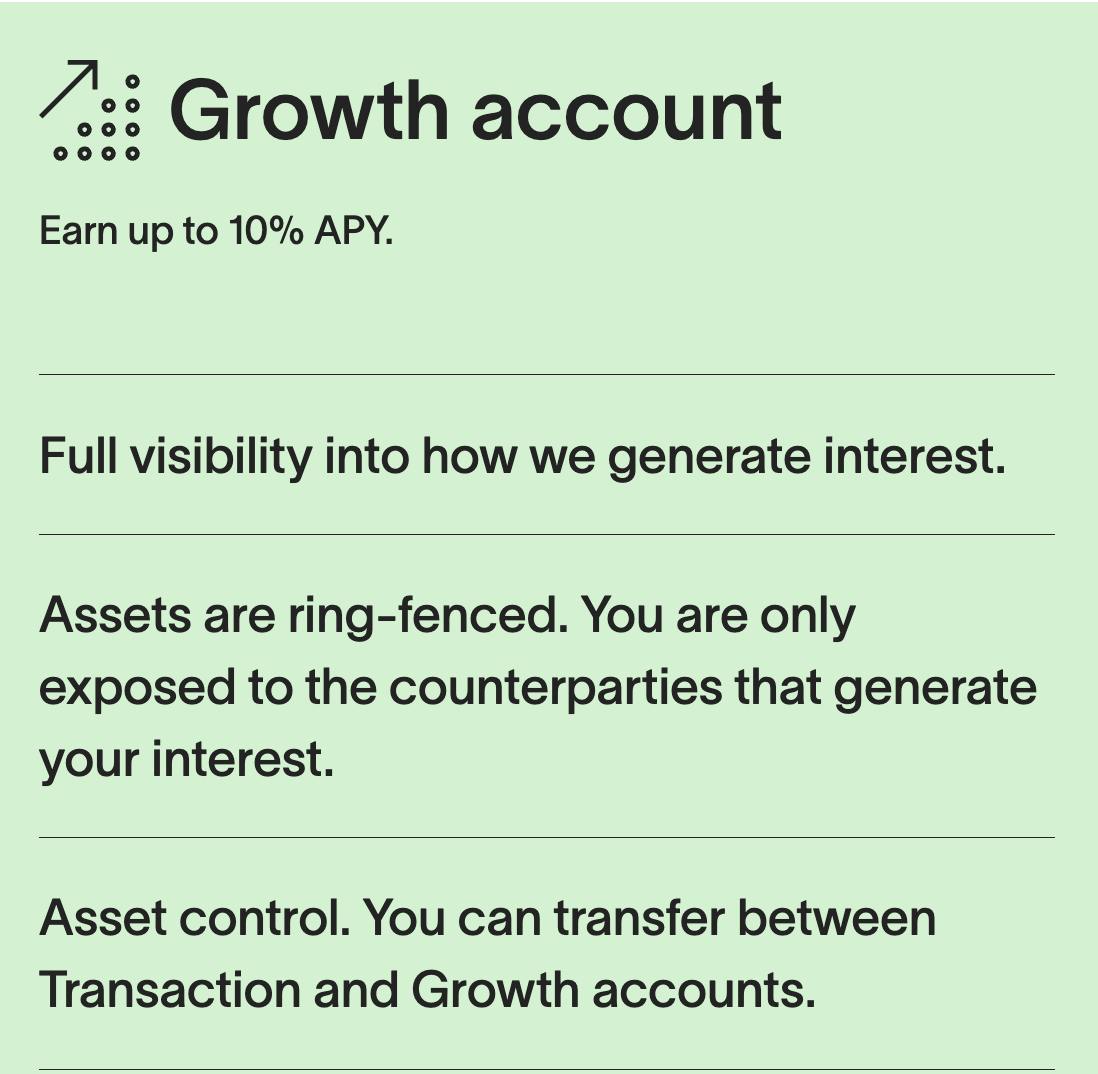

ROI. A large number of people also use stablecoins to store value and save money because the returns are quite attractive. Here are the interest rates of Ledn, one of the world's largest stablecoin savings platforms:

Ledn is considered one of the "safer" platforms. You have riskier schemes that can potentially generate up to 100% APY.

Opportunities for indie hackers

With the rise of AI, it appears like we've all forgotten about crypto.

Acquisitions like this serve as a reminder that cryptocurrency, particularly of the stablecoin variety, is alive and kickin'.

Back in February, Y Combinator called for stablecoin startups:

“We would like to fund great teams building B2B and consumer products on top of stablecoins, tools and platforms that enable stablecoin finance and more stablecoin protocols themselves…”

All of this suggests that stablecoin startups will become more popular as time passes.

First LemonSqueezy, now Bridge. We’re watching a monopoly form with our very eyes 😅

That being said, right now I’d rather have Stripe than any of its competitors.

Stripe acquiring Bridge for $1.1 billion shows how seriously traditional financial platforms are taking the crypto space, especially stablecoins. This acquisition isn't just another addition to Stripe's capabilities; it’s a play on the immense transaction volumes stablecoins are bringing in. For context, stablecoins are now driving 20x the transaction volume of PayPal and even doubling what Visa processes. That's insane growth for a financial product only about a decade old.

Bridge aligns with Stripe by giving it the infrastructure to support stablecoin transactions for developers through an API, essentially making cross-border payments faster and way more accessible. By handling money outside traditional bank verifications, stablecoins eliminate a lot of the usual fees and delays—a huge win for businesses and users alike.

This move also reminds indie hackers that crypto isn't going anywhere. With the rise of AI, some may have forgotten about the crypto space, but Stripe’s acquisition is a wake-up call that it’s still alive and booming. Plus, it’s a hint that both sectors—AI and crypto—could have a lot more overlap in the near future.

First time learning about how large the volume of transactions on the Stable coins eco-system, great read!

MetaMask is the biggest scam you can have , all my NFT and coins where stolen in a twinkle of an eye and their very rude customer care will ignore you and tell you there’s nothing they can do, expresshacker99 was competent enough to help me recover my lost asset. You can reach them via expresshacker99[at]gmail[dot]com.

Stripe’s bold $1.1 billion acquisition of a stablecoin company signals a powerful move towards integrating digital currencies into mainstream financial systems. This deal positions Stripe at the forefront of fintech innovation, enabling faster, cheaper, and borderless transactions. As stablecoins offer the benefits of cryptocurrency without volatility, this acquisition could redefine how businesses and individuals manage payments globally, marking a significant shift in the future of finance. Exciting times ahead!

Stripe's acquisition of a stablecoin company for $1.1 billion shows growing interest in digital currencies. This move could lead to more mainstream adoption of stablecoins and blockchain technology. It's a big deal for the fintech industry!

Stripe seems to be entering cryptomarkets with full energy!!

Crypto currency will be bought by stripe very soon and police clearance will be needed on this.

This comment was deleted 3 months ago