The second $100B AI

company

The case for consumer AI.

The case for consumer AI

By my count, there are 31 U.S. technology companies with a market cap over $100B. Of that list, I count only one founded in the last 15 years: Uber, which trades at $178B.

If we go back a few years—further back than 2009—we get a few more: Shopify (2006), Palo Alto Networks (2005), Meta (2004), ServiceNow (2004), Tesla (2003). And if we look beyond the United States, we get companies like Pinduoduo (2015) and Meituan (2010), both Chinese.

I expect the list of $100B+ tech companies founded since 2009 to grow in the coming years: Airbnb should join the ranks ($85B today), and Crowdstrike will eventually make it ($78B today). Private companies like SpaceX and Stripe should IPO and break the barrier. And I’m sure I missed a company or two in my quick analysis.

But the point is: there are not many technology companies that make it to $100B.

By 2034, in 10 years time, I expect we’ll have one or two AI companies join the ranks. New technology eras—internet, mobile, cloud—have traditionally propelled a couple new companies into that rarified air. The question now becomes: who’s next?

AI is the newest era in technology—and in The Mobile Revolution vs. The AI Revolution we argued that this era will be bigger than those that came before

My prediction is this: the first AI company to eclipse $100B in market cap will be a consumer AI company.

This piece was initially titled, “The First $100B AI Company.” I changed the title to “The Second $100B AI Company” because we know the first: OpenAI, which just raised $6.6B at a $157B valuation (the largest venture round ever). Of course, OpenAI is both a foundation model company and an application company, a consumer company and an enterprise company. For the purposes of this piece, we’ll assume OpenAI goes public and eclipses that $100B threshold. The more interesting question becomes: what other companies will achieve the same? Which company becomes the second company to hit $100B in market cap?

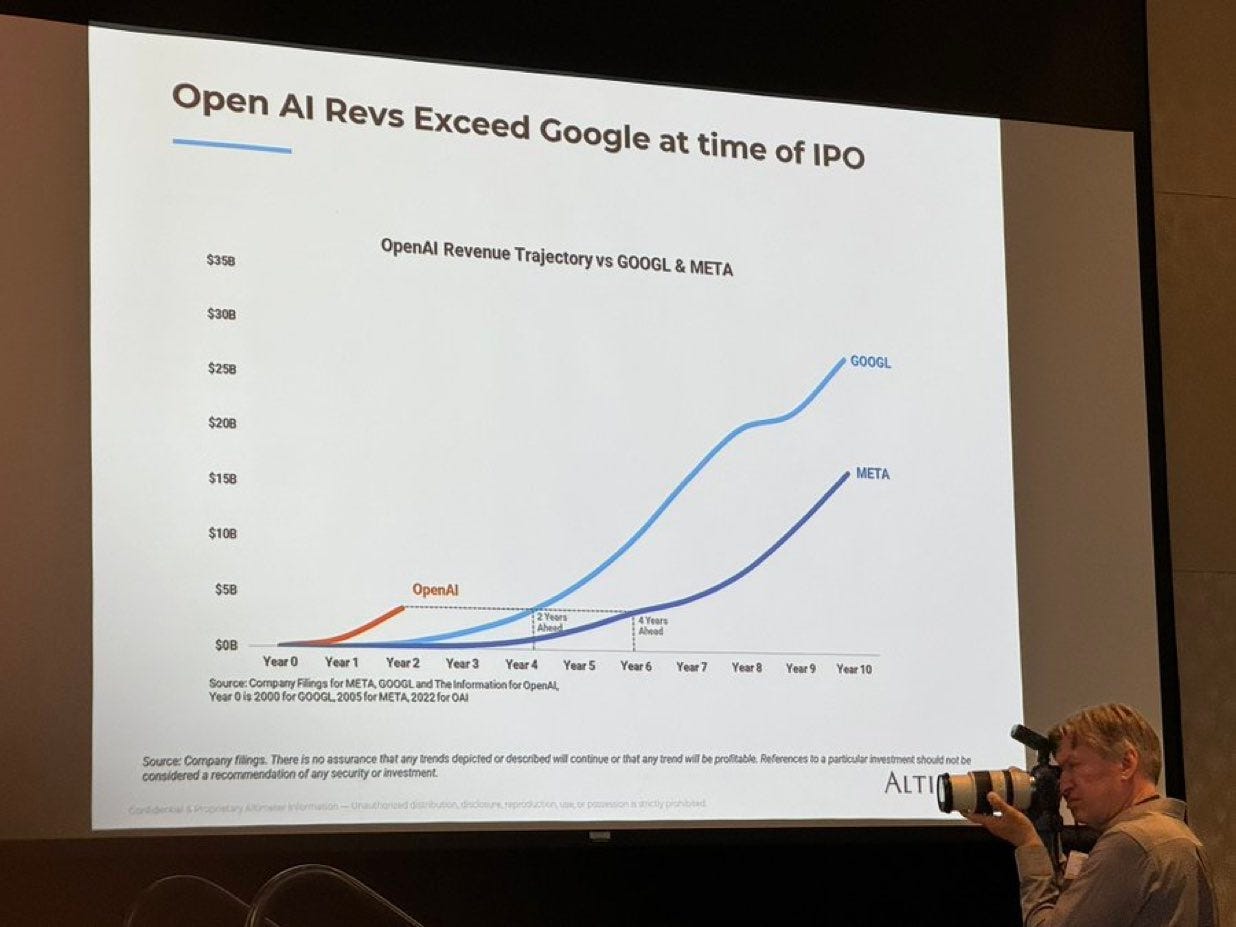

The case for OpenAI’s $157B price—a price tag that would give most investors sticker shock—is its revenue trajectory and centrality to the AI revolution. Take this chart from Altimeter’s Brad Gerstner, which positions OpenAI’s revenue growth alongside Google’s and Facebook’s:

Source: Brad Gerstner and Eric Newcomer

Impressive. Not many companies can grown revenue from $3.7B to $11.6B in a year, as OpenAI expects to do next year. (The company generated $300M in revenue last month, up 1,700% since the start of the year.)

The above chart makes a compelling case for the $157B valuation. Google trades at a $2.05 trillion market cap, Meta at $1.49 trillion. It was only in 2018 that Apple became the first tech stock to eclipse the $1T barrier; today, Apple trades at $3.6T and we have six trillion-dollar tech companies. Ten years out, the list of $1T companies may double or triple, and OpenAI has a real path to that mark given its importance to both AI’s foundation model layer and application layer. The world is getting bigger, catalyzed by rapid technological innovation; in the coming decade, $1T might be the new $100B and $100B might be the new $10B.

As AI’s foundation layer has crystallized, we’ve seen a few fiefdoms emerge. OpenAI is aligned with Microsoft, of course; Anthropic is partnered with Amazon / AWS; Google has DeepMind; and Meta is investing heavily into the space. The (likely) winners at this layer of the stack are set. So if the foundation layer is stabilizing, where does new value get created? The application layer, of course.

My favorite excerpt from Sequoia’s recent piece on AI was this paragraph:

Imagine you want to start a business in AI. What layer of the stack do you target? Do you want to compete on infra? Good luck beating NVIDIA and the hyperscalers. Do you want to compete on the model? Good luck beating OpenAI and Mark Zuckerberg. Do you want to compete on apps? Good luck beating corporate IT and global systems integrators. Oh. Wait. That actually sounds pretty doable!

The app layer is still early, and 2024, 2025, and 2026 should be key vintages for AI applications. (Comparing to mobile: the period of 2009 to 2013 birthed companies like Uber, Lyft, Instagram, Snap, Robinhood, and Coinbase.)

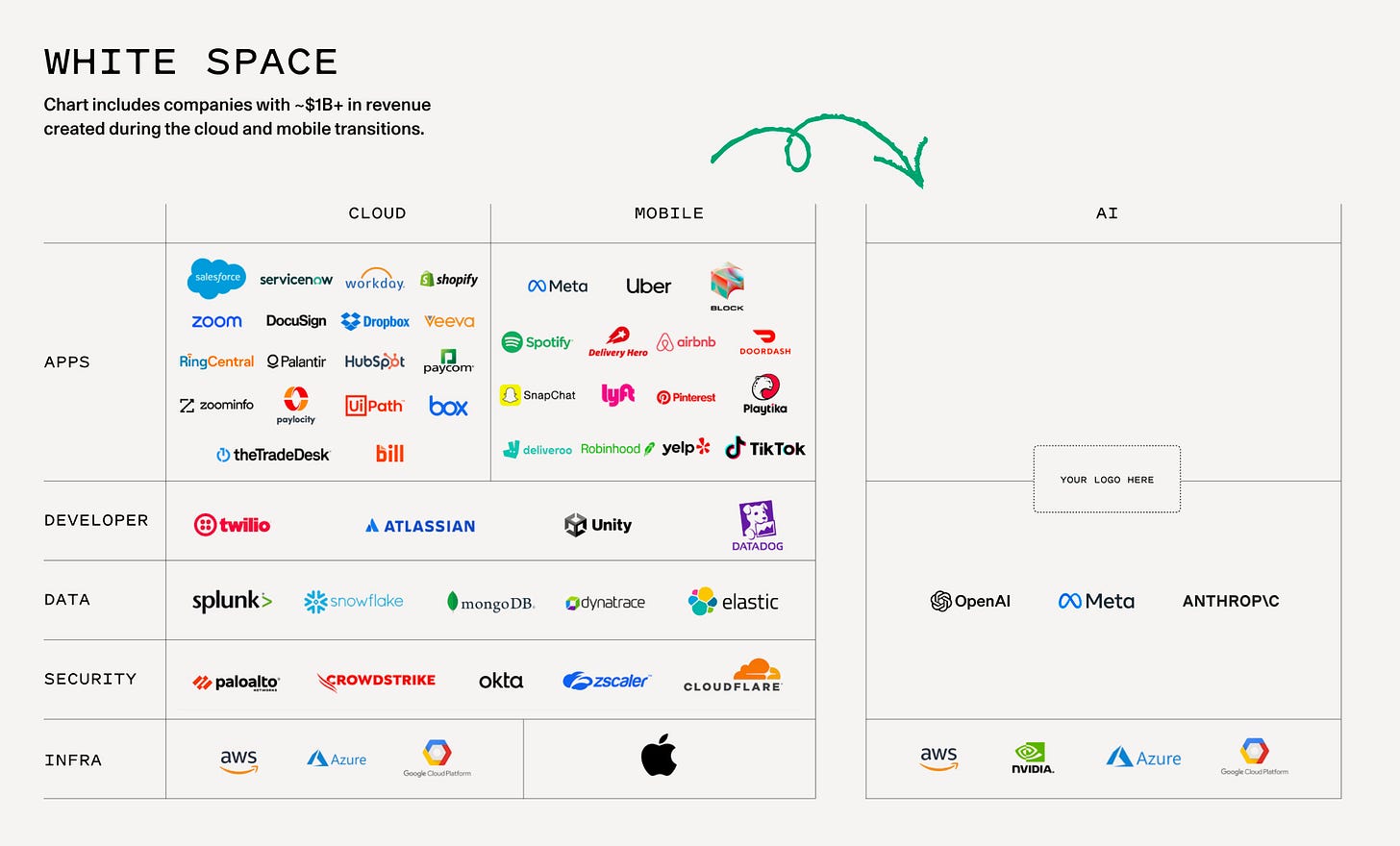

The cloud transition gave us roughly 20 companies doing over $1B in revenue; the mobile transition gave us another 20. So what will be the 20 companies borne from the AI revolution that do $1B+ in revenue?

A graphic from Sequoia showing the ~20 companies that do $1B+ in revenue created from cloud and mobile; Source

This is an interesting framework through which to approach early-stage entrepreneurship and venture capital. Today’s an exciting moment in time: it’s not unlikely that a company that will eventually find itself in the top right of the chart above—$1B+ in revenue—is being created this very month. We may have five or six of those companies created this year.Much of the focus on AI has been on B2B agents. In Digital Native we’ve covered how AI is eating away at services—big categories like law, insurance, banking. (See: AI Is a Services Revolution.) Services are a multi-trillion-dollar opportunity, and many of the disrupters here will be B2B. But others will be B2C, and history has shown that venture-backed B2C outcomes are often bigger. We looked through this data in June’s The Consumer Renaissance.

It’s a little bizarre that VCs are still skittish on consumer today. Again, big consumer wins are typically larger than big enterprise wins—relative to Snowflake’s market cap, Uber is ~3x in size, Airbnb is ~2x in size, and DoorDash is roughly equal. (Snowflake is the biggest enterprise IPO of the last decade.)

And we’re only a few years removed from huge outcomes. Here are five companies that IPO’d in the past five years, and what a $1M check into the Seed round would yield at IPO:

All of these are pure-play consumer, except Unity, which is a pick-and-shovel on consumer spend in gaming. Forerunner put out data earlier this year that backed up these arguments: of the consumer companies that went public, they found, 18.8% had an IPO at a valuation of more than $10B, nearly double the 9.6% rate for enterprise companies.

So it’s somewhat confounding that “consumer” has become something of a bad word. A good rule-of-thumb for early-stage venture: when a category is out of favor, it’s probably a good place to spend time. Enter: consumer AI.

I think it’s likely that the biggest AI wins are in consumer. There might be more IPOs in enterprise, of course—more companies clustered in the $5-10B market cap range. And it’s important to also spend time there; our most recent Daybreak investment is a B2B AI company building in the legal space. But the size of the outcomes in consumer will probably be larger. So what are the $1B+ revenue companies being built in consumer AI?One framework is to look at large categories for consumer spend ($) and consumer engagement (time). To take three examples:

Each “incumbent” is vulnerable. To take the “service-as-a-software” framework, for each category we can think of an expensive human that is now able to be replaced—democratized—by software:

The above categories may yield $5-10B companies, but they probably won’t yield $100B+ companies. I’m not sure the markets are large enough (though market sizing is always a fool’s errand). If I had to wager on which segments of consumer will produce $100B+ AI companies:

Video made up 80% of internet traffic last year. We’re only on the cusp of everyday people being able to create gorgeous, high-quality video using AI. Think back to OpenAI’s stunning Sora demo earlier this year.

Prompt: “An adorable happy otter confidently stands on a surfboard wearing a yellow lifejacket, riding along turquoise tropical waters near lush tropical islands, 3D digital render art style.”

Prompt: “A stylish woman walks down a Tokyo street filled with warm glowing neon and animated city signage. She wears a black leather jacket, a long red dress, and black boots, and carries a black purse. She wears sunglasses and red lipstick. She walks confidently and casually. The street is damp and reflective, creating a mirror effect of the colorful lights. Many pedestrians walk about.”

Online shopping, meanwhile, is a $16T market growing to over $75T (!) by 2034. An AI-native commerce company—like the company in the Daybreak portfolio that gives everyone a personal stylist—could rake in hundreds of billions in GMV.

And gaming is the largest category in media—about $250B in sales this year. A generative gaming platform that lets anyone create and explore game-worlds (call it an AI Roblox or Minecraft, if you will) would be a large business.

Of course, in every category we’ll have fierce competition from incumbents. To take video as an example:

There’s the aforementioned Sora, which blew everyone away when it was demoed in February.

Meta unveiled Video Gen, a powerful AI engine that it plans to release next year.

Adobe just released the public beta for its Firefly Video Model, which allows Creative Cloud subscribers to generate short video clips.

It will be a battle between incumbents and disruptors to capture the $$. The incumbents should get richer—a rising tide lifts all boats—but there will also be a few AI-native companies that become generational companies.

As a final reminder, the original FAANG was…entirely consumer. Now, don’t ask me why Microsoft wasn’t included—probably because FAAMG doesn’t have the same ring to it—but still. Consumer tech companies can be very, very large—and we’re in the early innings of the biggest technology revolution in decades.

The size of the opportunity is coinciding with a relative lack of startup creation. Y Combinator’s Michael Seibel recently tweeted about the imbalance between B2B and B2C AI companies—an imbalance clearly visible to anyone who spent time with the last YC batch.

There are probably a few Series A and B companies that will find their logos in the top-right of the earlier chart, in a version 10 years in the future. There are probably a few Seed companies that will find themselves there too. And there are definitely a lot of companies that haven’t been created yet, but that will be founded in 2025 and 2026 and 2027.

This article was originally published here.

This perspective is refreshing Rex , While early movers in consumer AI have a unique opportunity to shape the market, established apps like Amazon with its Rufus feature are already leveraging generative AI, making the space both dynamic and highly competitive.

The dynamic nature of the consumer AI landscape means that while startups may innovate rapidly, they must contend with the significant resources and customer bases that established companies can deploy. For instance, Amazon's integration of generative AI into its shopping experience exemplifies how incumbents are not just passive participants but active shapers of market trendslook ahead, it will be fascinating to see how these early-stage companies navigate this competitive environment and whether they can carve out a niche amid the advancements from giants like Amazon, Google, and Meta .

Your article raises some compelling points about the future of consumer AI and its potential to create the next wave of $100B companies. The emphasis on consumer-facing applications in AI resonates with the current trend where venture capital is often hesitant to invest in consumer tech, despite its historical capacity for generating massive returns.

Your prediction that OpenAI will set the stage for other AI companies to follow in its footsteps is particularly intriguing. It’s clear that the application layer of AI is still in its infancy, and with sectors like video, online shopping, and gaming poised for disruption, the opportunities for innovation are immense.

I'm curious to see which companies will rise to the occasion in this space and whether they can truly capture the market in the same way consumer giants have in the past. Exciting times ahead!

It will be interested to see what companies are formed in the next 5-10 years. Right now it seems the incumbents will utilize AI to further improve their products which could make it harder for new players to step in to the arena. The ones that do will be radically different.